Burien’s Opportunity Zones Are a Favorable Tax Incentive

Investors looking to decrease their tax burden should consider investing in projects within Burien’s Opportunity Zones. This federally designated program can be leveraged to increase a project’s overall profitability. Burien is home to some of the few designated Opportunity Zones in all of Washington state. Incorporated through the new federal Tax Cuts and Jobs Act of 2017, Opportunity Zones offer federal capital gains tax relief for individuals who invest in the designated zones. By investing in Burien businesses and property through a Qualified Opportunity Fund, investors can defer and even eliminate capital gains taxes on investments made within the Opportunity Zone.

Investors looking to decrease their tax burden should consider investing in projects within Burien’s Opportunity Zones. This federally designated program can be leveraged to increase a project’s overall profitability. Burien is home to some of the few designated Opportunity Zones in all of Washington state. Incorporated through the new federal Tax Cuts and Jobs Act of 2017, Opportunity Zones offer federal capital gains tax relief for individuals who invest in the designated zones. By investing in Burien businesses and property through a Qualified Opportunity Fund, investors can defer and even eliminate capital gains taxes on investments made within the Opportunity Zone.

Why Invest in Burien?

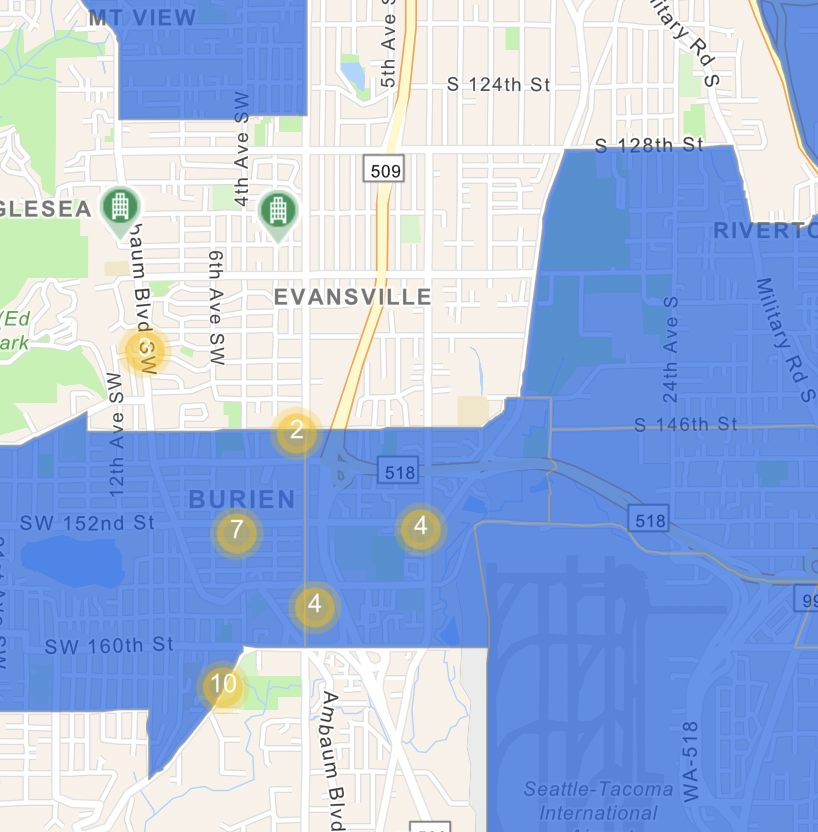

Burien is the home of two designated Opportunity Zones that offer a variety of investment options.

- Our downtown district has a Walk Score of 90 and is one of the most vibrant downtown communities in the area.

- Our Northeast Redevelopment Area (NERA) is a 458,000-square-foot development plot that is expected to bring 600–800 family-wage jobs over the next three years.

- Our proximity to Seattle-Tacoma International Airport creates opportunities for local businesses needing Port and travel access, along with those in the hospitality sector.

- Our city council is open to working with developers and eager to hear ideas!

Opportunity Zone FAQs

What are the Tax Benefits of Opportunity Zones?

- You may defer tax payments on prior gains from an investment located outside of an Opportunity Zone by transferring the gains to a Qualified Opportunity Fund. Tax payments are deferred until the date on which the Opportunity Fund investment is sold, exchanged, or December 31, 2026 when the program expires.

- If the Opportunity Zone investment is held for longer than 5 years, the taxable gain is reduced by 10 percent.

- If the Opportunity Zone investment is held for longer than 7 years, the taxable gain is reduced by 15 percent.

- If the Opportunity Zone investment is held for at least 10 years, the capital gains tax paid could be reduced to zero.

What is a Qualified Opportunity Zone (QOZ)?

- Qualified Opportunity Zones are census tracts (neighborhoods) identified by the federal government.

- Since the law passed, Opportunity Zones have been identified in all 50 states and U.S. territories, including Burien’s downtown and industrial opportunity zones.

- Through a competitive process, Burien earned designation of two tracts last spring. The process is now closed and no new areas may be designated. View the U.S. Internal Revenue Code requirements.

What is a Qualified Opportunity Fund (QOF)?

- Investments seeking capital gains tax relief must be made via a QOF, or Opportunity Fund. Investors may self-qualify the funds. For more information on this process, see the Internal Revenue Service website or consult your tax professional.

- QOFs can be created by LLCs as well. An entity that chooses to be treated as a partnership or corporation for federal tax purposes can organize as a Qualified Opportunity Fund.

What are the Limitations on Opportunity Zone Projects?

- Investments must be made through an Opportunity Fund to qualify for the capital gains tax incentives.

- To qualify for the tax incentive, Opportunity Funds must invest at least 90 percent of their assets in Qualified Opportunity Zone Properties, which can be any of the following:

- Businesses operating within an identified Opportunity Zone.

- Stocks in businesses that conduct most or all of their business within an identified Opportunity Zone

- Property located within an identified Opportunity Zone

- Gains on capital investments must be reinvested into an Opportunity Fund within 180 days to qualify.

- There is no financial limit to how much an Opportunity Fund can invest in a community.

Who Benefits from Opportunity Zones?

- Burien benefits from the development of underused or poorly maintained property to increase available housing and commercial space.

- Investors and companies that choose to either put money into an Opportunity Fund or create one themselves.

- Investments from Opportunity Funds can be allocated towards qualifying businesses or real estate property. To verify a specific address, contact Economic Development Manager Chris Craig, 206-439-5579 or chrisc@burienwa.gov.

- Local businesses in Opportunity Zones benefit from increased investments.

Does this Opportunity Zone Program Expire?

- Yes, on December 31, 2026.